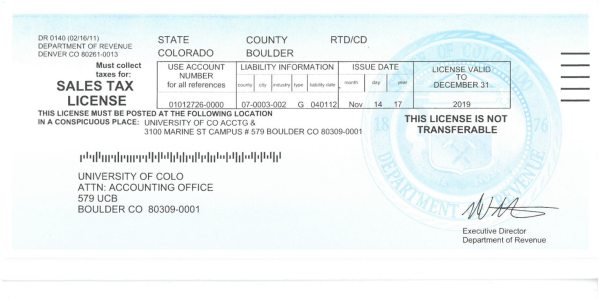

boulder co sales tax license

CITY OF BOULDER BUSINESS LICENSE APPLICATION SALESUSE TAX - ADMISSIONS - ACCOMMODATIONS LICENSE City of Boulder - Finance Department Official Use Only. 13 rows Boulder County does not issue licenses for sales tax as the county sales tax is.

Sales Tax Campus Controller S Office University Of Colorado Boulder

Boulders sales tax rate is 845 with a 25 rate.

. Sales Tax Accounts Licenses. This is the total of state county and city sales tax rates. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

How to Apply for a Sales and Use Tax License. Colorados state sales tax is 9 and its 0 percent. A Boulder Colorado Sales Tax Permit can only be obtained through an authorized government agency.

The Colorado sales tax license in other parts of the country may be called a resellers license a vendors license or a resale certificate is for state and state-administered sales and use taxes. When a business applies. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers.

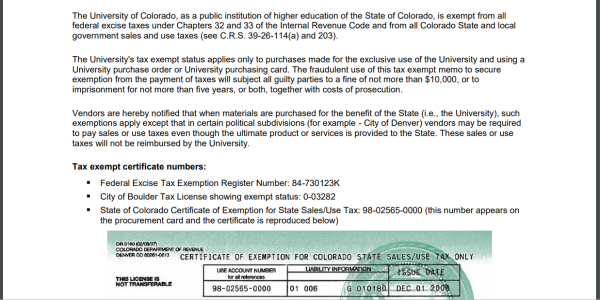

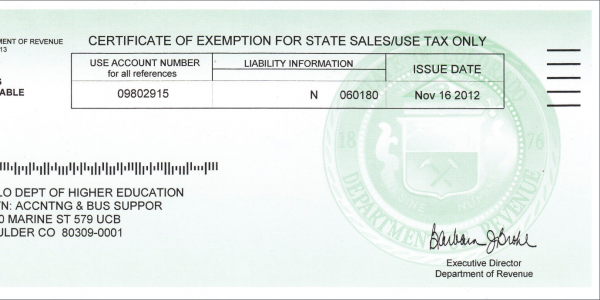

2 Get a resale certificate fast. Ad 1 Fill out a simple application. When the university sells tangible property to non-university non-tax-exempt entities the sale is subject to sales tax.

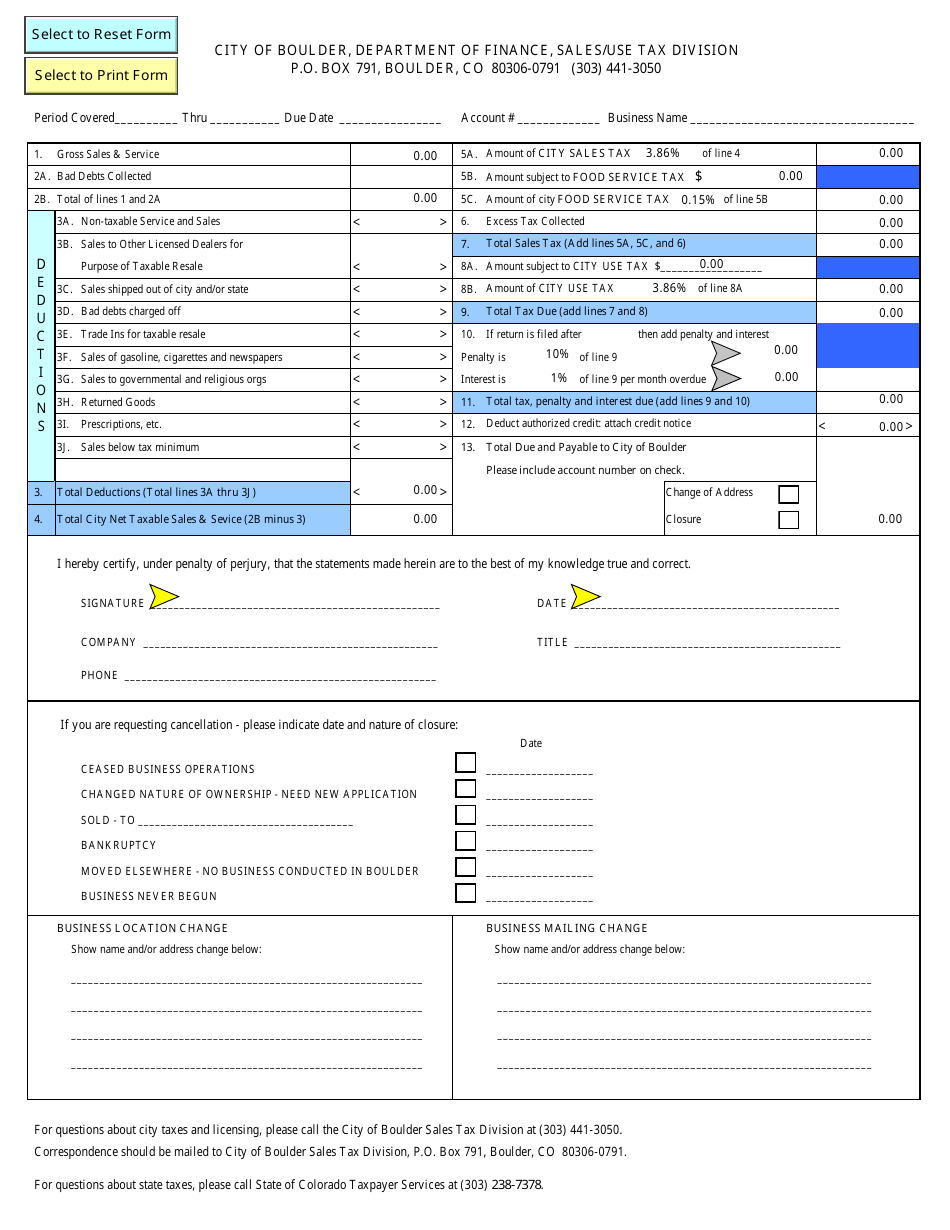

Renew a Sales Tax License. Ad Compliance Begins With Being Registered In States Where You Do Business. The City of Boulder requires all organizations and businesses coming into Boulder for Special Events to obtain a City of Boulder business license and file a sales use tax return.

About city of boulders sales and use tax. Add Locations to Your Account. Depending on the type of business where youre doing business and other specific.

Sales Tax Accounts Licenses. Sales tax licenses are required from both the city and state for businesses to operate in the City of Boulder. The state of colorado special events license application can be found here.

The minimum combined 2021 sales tax rate for Boulder Colorado is. 2 Get a resale certificate fast. How to Apply for a Sales Tax License.

State of Colorado Boulder County and RTD taxes are remitted to the State of. The Colorado sales tax rate is currently. Ad 1 Fill out a simple application.

TaxMatrix Helps You Register With State Agencies. Generally any retailer that is required to collect Colorado sales tax must obtain and maintain a Colorado Sales tax license collect and remit sales tax to the State. The Boulder Colorado sales tax rate for 2021 is 8 percent.

To obtain a license you must first complete a City of Boulder Sales and Use Tax Business License Application and submit the completed application along with a one-time. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers. How to apply for a sales and use tax license.

This ordinance was developed by home rule. Complete a Business License. Boulder county sales tax RTD and SCFD sales taxes.

This includes sales made to students faculty and staff not acting in an. Is required to obtain a sales tax license the seller may not be required to collect the state and state-administered sales taxes. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to.

This ordinance was developed by home rule.

Getting Your Business Established In Boulder Colorado

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Moving To Boulder Boulder Co Relocation Homebuyer Guide

Sales Tax Campus Controller S Office University Of Colorado Boulder

Getting Your Business Established In Boulder Colorado

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder